Processing...

`V = SPOT("platinum")* W * 100 * (1- #scrap - #profit)`

Enter a value for all fields

The Precious Metal Alloy Value calculator computes the raw bullion value for gold, platinum, palladium or silver alloy based on the metal, weight, purity and current spot price.

INSTRUCTIONS: Choose units (e.g. pennyweight or gram) and enter the following:

- (W) Weight of Precious Metal Alloy

- (M) Type of Precious Metal (CHOOSE: gold, platinum, palladium or silver)

- (P) Percentage of Metal's Purity (e.g 98,5%). This is a percentage not a karat.

Precious Metal Alloy Value (V): The raw bullion value is returned in United States dollars (USD). However, this can be automatically converted to other currencies via the pull-down menu.

The Math / Science

The value of precious metal alloy to a jeweler is the refined value of the metal in the alloy minus the refining fee and the jeweler's fee. The formula for the Precious Metal Alloy Value is as follows:

V = SPOT(M) • W • P

where:

- V is the value of the precious metal alloy

- W is the measured weight or mass of the precious metal

- M is the precious metal (gold, platinum, palladium or silver)

- SPOT(M) is the current spot price of the precious metal

- P is the percent purity of the precious metal

SPOT comes from /www.xmlcharts.com/cache/precious-metals.xml

Gold Coin Calculator

| Gold SPOT PRICES | ||

| ($/gram) | ($/troy_oz) | |

| $177.729 | $5527.99 | |

| UPDATED: 2026-01-29 03:30 AM UTC | ||

- US Gold Eagle Coin Value: Computes the value of U.S. Gold Eagle coins based on their size, the number of coins, SPOT and any numismatic factors.

- Value of 1oz US Gold Eagle Coins: Computes the current market value of 1oz US Gold Eagles

- Value of 1/2 oz US Gold Eagle Coins: Computes the current market value of 0.5 oz US Gold Eagles

- Value of 1/4 oz US Gold Eagle Coins: Computes the current market value of 0.25 oz US Gold Eagles

- Value of 1/10 oz US Gold Eagle Coins: Computes the current market value of 0.1 oz US Gold Eagles

- Gold Maple Leaf Coins Value: Computes the value of Canadian Maple Leaf coins based on their size, the number of coins, SPOT and numismatic factors.

- Krugerrand Coins Value: Computes the value of South African Krugerrand coins based on their size, the number of coins, SPOT and numismatic factors.

- 20 Swiss Gold Franc Value: Computes the value of 20 Swiss Franc coins based on the number of coins, SPOT and any numismatic factors

- Gold British Sovereign Coins Value: Computes the value of British Sovereign coins based on the number of coins, SPOT and numismatic factors.

- 20 Italian Gold Lira Coin Market Value

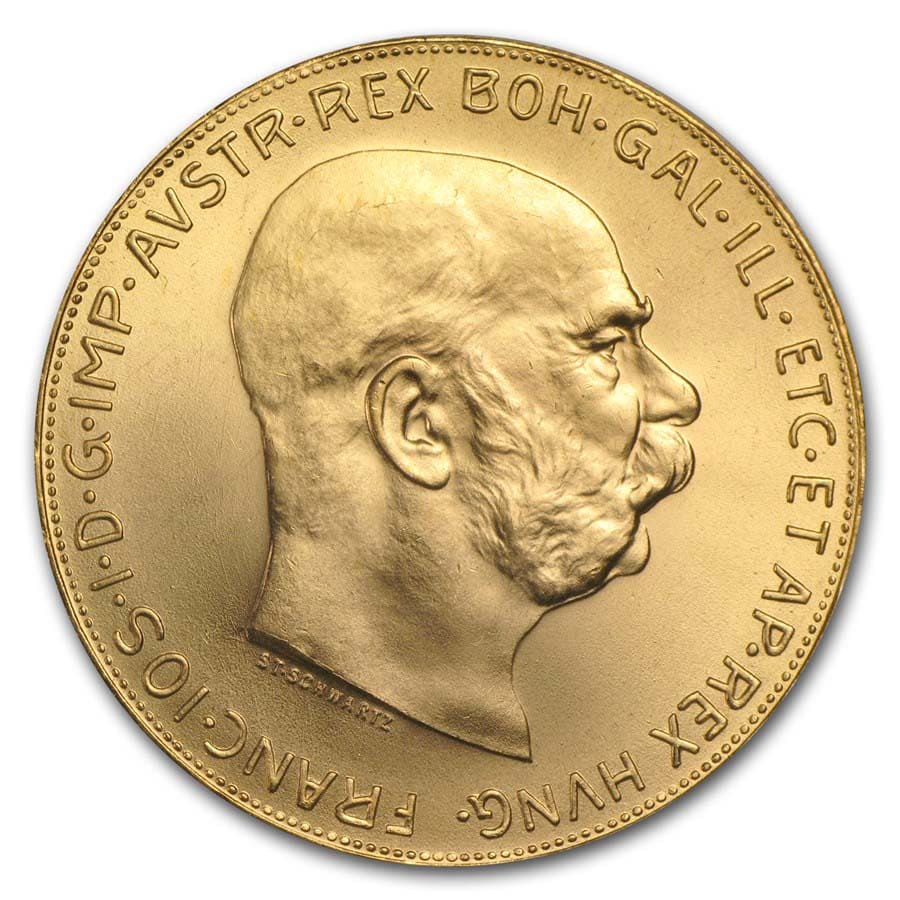

- 100 Austrian Corona

- Zimbabwe 1 oz Gold Coin Value: Computes the value of a Mosi-oa-Tunya coin based on the current spot price of gold and a mint adder.

- Gold Value: Computes the value of gold based on the weight, karat purity, a refiner's fee and a fee to the retailer (jeweler).

- Alloy Value: Computes the value of platinum, palladium, silver or gold based on the weight, percent purity, a refiner's fee and a fee to the retailer (jeweler).

- Gold SPOT: The value of a gram, penny weight or troy ounce of gold bullion (.9999) in U.S. dollars or other currencies.

- Density of Gold: Mean density of gold bullion (.9999).

| Gold Coins | |

|---|---|

|

|

|

Basic Investor Calculators

- Black-Scholes Equation: Compute the Call and Put Option based on the Black-Scholes equation and the stock or spot price, strike price, number of years to maturity, percent volatility and the risk-free rate.

- 30 Day Yield Equation: Computes the SEC's 30 day yield function for bond funds based on the income in the prior 30 days, accrued expenses in the prior 30 days, outstanding shares and max price per share.

- Investment Return Rate: Computes the return rate based on the beginning and end price and dividends paid.

- Inflation Adjusted Return: Computes the return rate based on the Inflation Rate and the Investment Return.

- Present Value- computes the present value of a fixed annuity.

- Future Value- computes the future value of a fixed annuity.

- Interest Rate for Future Value - computes the annual fixed interest rate required for a present value to accrue to the future value over a number of periods.

- Number of Periods Required - computes the number of periods required to achieve a future value from a present value at a fixed annual interest rate.

- Precious Metal Value - computes the current market value of gold, platinum, silver and palladium based on bullion weight and purity.

- Credit Card Equation - computes the time required to payoff a debt based on an interest rate, initial balance and monthly payment.

- Currency Conversion - computes the current value of a currency amount (e.g., $2,000 US dollars) in Euros, Great Britain Pounds, Canadian Dollars, Yuan, Yen, Rubbles, Swiss Francs, Australian Dollars, South African Rands, Brazial Reals, Mexican Pesos, Indian Rupees and U.S. dollars.